By KIP SULLIVAN, JD

At its April 4, 2019 meeting, the staff of the Medicare Payment Advisory Commission (MedPAC) asked the commission to discuss a very strange proposal: Doctors who treat patients enrolled in Medicare’s traditional fee-for-service (FFS) program must join an “accountable care organization” (ACO) or give up their FFS Medicare practice. (The staff may have meant to give hospitals the same Hobbesian choice, but that is not clear from the transcript of the meeting.)

Here is how MedPAC staffer Eric Rollins laid out the proposal:

“Medicare would require all fee-for-service providers to participate in ACOs. The traditional fee-for-service program would no longer be an option. Providers would have to join ACOs to receive fee-for-service payments. Medicare would assign all beneficiaries to ACOs and would continue to pay claims for ACOs using standard fee-for-service rates. Beneficiaries could still enroll in MA [Medicare Advantage] plans. (p. 12 of the transcript)”

The first question that should have occurred to the commissioners was, Are ACOs making any money? If they aren’t, there’s no point in discussing a policy that assumes ACOs will flourish across the country.

But only two of the 17 commissioners bothered to raise that issue. They asserted that Medicare ACOs are saving little or no money. Those two commissioners – Paul Ginsburg and commission Vice Chairman Jon Christianson – did not mince words. Ginsburg said ACO savings were “slight” and called the proposal to push doctors into ACOs “hollow” and premature. (pp. 62-63) Christianson was even more critical. He said the proposal was “really audacious,” and that no “strong evidence” existed to support the claim that ACOs “can reduce costs for the Medicare program or improve quality.” (pp. 73-74) Ginsburg and Christianson are correct – ACOs are not cutting Medicare’s costs when Medicare’s “shared savings” payments to ACOs are taken into account, and what little evidence we have on ACO overhead indicates CMS’s small shared savings payments are nowhere near enough to cover that overhead.

But Ginsburg and Christianson might as well have been talking to a wall. The other 15 commissioners had no comment. In fact, the majority of them said ACOs are saving money for Medicare and endorsed further consideration of the staff’s suggestion that doctors should have to choose between joining an ACO or never again billing the FFS Medicare program.

The only other objection offered at the meeting came from commissioner Marjorie Ginsburg. She noted that under the staff’s proposal beneficiaries would have to enroll in an ACO (currently beneficiaries are assigned to one without their knowledge), and they would have to suffer financial penalties if they saw providers outside of their ACO. But, she warned, that will be “a really hot-button issue and we have to be extremely careful in how we present this going forward or we’re going to get hammered.” (p. 88) Yet even Ginsburg said punishing doctors who didn’t join ACOs was worth further discussion.

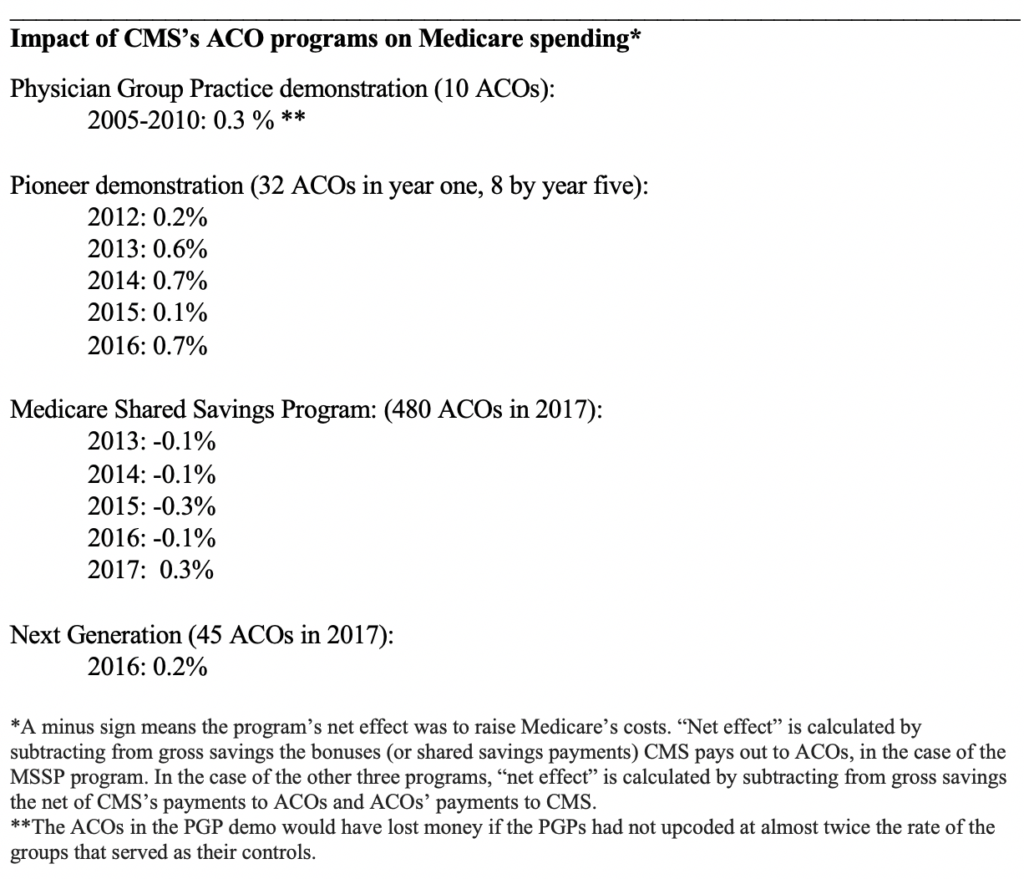

Four ACO programs, same results: No savings

As the table below indicates, the four ACO programs the Centers for Medicare and Medicaid Services (CMS) has established since 2005 have had almost no impact on Medicare spending. [1] The four programs have raised or lowered Medicare’s net spending by only a few tenths of a percent. Please note that three of the four programs – the Physician Group Practice (PGP) demonstration (which ran from 2005 to 2010), the Pioneer ACO demonstration (2012 to 2016), and Next Generation demonstration (it began in 2016) – exposed ACOs to two-sided risk, that is, to the risk of sharing losses as well as savings. Only the Medicare Shared Savings Program (MSSP), a permanent program that began in 2012, exposed ACOs only to upside risk (the chance to make money). I point this out because ACO proponents seek to excuse the poor performance of the MSSP by claiming MSSP ACOs are not exposed to downside risk (the risk of losing money). The best known proponent of this evidence-free explanation is probably Seema Verma, Trump’s CMS administrator. MedPAC also promotes this notion. But as the table indicates, exposure to downside risk makes little difference. The three two-sided-risk programs performed only a few tenths of a percent better than the MSSP has.

_______________________________________________________

ACO proponents have not been happy with these results. But rather than concede the ACO isn’t working, they have argued there is something wrong with the way CMS measures ACO savings and losses. They say CMS’s use of historical rather than concurrent control groups renders CMS’s estimates of savings and losses inaccurate. If CMS would use concurrent controls, they say, ACOs would look better.

I won’t get into the gory details of this claim. [2] All you really need to know is that research using concurrent controls produces the same underwhelming results – ACOs still save only a few tenths of a percent. For example, the study of the PGP demo that produced the measly three-tenths of a percent savings (see table above) used concurrent controls. Similarly, a study of the MSSP by J. Michael McWilliams using concurrent controls reported a seven-tenths-of-one-percent savings for 2013-2014 (my calculation based on data reported in Table 2, p. 1712), while the National Association of ACOs reported a three-tenths-of-a-percent savings for the MSSP for 2013-2015 (see slide 9 in this presentation by MedPAC staff at the commission’s January 2019 meeting).

No margin, no mission

So if Medicare ACOs are breaking even for Medicare, or are at best cutting Medicare’s costs by half a percent net, that means the average ACO is receiving about half of that tiny savings in the form of shared savings payments, i.e., somewhere between zero and a quarter of a percent. And that in turn means the average ACO is losing money. Our commonsense tells us that has to be true because we know no human enterprise can operate without at least some overhead costs, and the overhead costs incurred by ACOs have to be a lot higher than one-fourth of a percent.

So, you ask, how high are Medicare ACO overhead costs? Surely after 14 years and four ACO programs, CMS, the ACO industry, and health services researchers have published research on this issue. Wrong. The only information we have are occasional statements by MedPAC, based on nothing more than a few interviews with ACO managers, that ACO administrative costs total approximately 2 percent. MedPAC informs us, moreover, that this number does not include extra services given to patients by ACOs in their (largely futile) efforts to cut net Medicare spending. Those two numbers together – administrative costs plus the cost of additional services delivered directly to patients such as educational and transportation services – may well exceed ten percent of total Medicare Part A and B spending attributable to some or most ACOs. [3]

Even if ACO overhead is just 2 percent, what possible rationale is there for continuing the ACO experiment, much less for forcing doctors to choose between joining an ACO and giving up their FFS Medicare practice? There is none.

Learning from the crash of lead balloons

How do we explain MedPAC’s obtuse behavior?

Unfortunately, this problem is not peculiar to MedPAC, it’s just more visible within MedPAC because, unlike the numerous other institutions that endorse evidence-free health policy, the commission’s deliberations are public. MedPAC’s dysfunctional thinking reflects habits of thought generated within the larger culture created by the managed care movement decades ago (for a longer discussion of this culture, see pp. 154-170 of my article with Ted Marmor). These habits of thought – a preference for abstraction, frequent use of labels designed to manipulate rather than inform (i.e. “accountable care”), and a cavalier attitude toward evidence (i.e., no interest in ACO overhead costs and misrepresentation of research on ACOs) – are rarely challenged by MedPAC members, in part because experts who don’t exhibit these habits of thought are rarely appointed to the commission. And on the infrequent occasion when those habits are challenged by one of the commissioners, no discussion ensues.

The commission’s failure to discuss Jon Christianson’s unvarnished criticism of ACOs at its April 4 meeting is a good example. In addition to asserting that ACOs are not saving money, he warned his fellow commissioners that ACOs are even less likely to work today than five years ago because of the rapid consolidation of the system. He cited the recent “Aetna-CVS kind of vertical merger, [and] all of the horizontal mergers that we’ve seen in the hospital industry.”(p. 76) The response? Crickets.

Because MedPAC has been such a prolific endorser of evidence-free health policy fads (pay-for-performance [P4P], incentives to buy electronic medical records, “medical homes,” ACOs, punishment for “excess readmissions,” etc.), it is conceivable the commission’s devotion to orthodoxy will eventually be undermined by reality – by a string of undeniable failures of programs MedPAC recommended. MedPAC’s endorsement of P4P in the early 2000s and its subsequent retraction of P4P for individual doctors (as opposed to groups) illustrates this possibility. In 2015, Congress accepted the advice of MedPAC and other managed care proponents and enacted what may be the planet’s largest P4P program – the doomed Merit-based Incentive Payment System (MIPS) (it was part of the MACRA law). At that point, MedPAC resembled the dog that caught the car. They had what they had been recommending for over a decade, and now it didn’t look like anything they could use. After a long delay, MedPAC voted (on January 11, 2018) to urge Congress to repeal MIPS.

Was the MIPS vote an aberration? Let us hope not.

Kip Sullivan is a member of the Health Care for All Minnesota advisory board and of the Minnesota chapter of Physicians for a National Health Program.

Footnotes

[1] The table does not list two smaller ACO programs run by CMS – a demonstration for dialysis centers, and a one-ACO program for Vermont known as the Vermont All-Payer ACO Model demonstration.

[2] In this footnote I’ll introduce the reader to the main issues raised by those ACO proponents who argue that CMS’s use of historical controls is not as accurate as research using concurrent controls. I’ll begin by noting, as I did in the text, that this argument can’t explain the paltry three-tenths-of-a-percent savings for the PGP demonstration. CMS used a concurrent control group in that demo.

For the three post-2012 programs (Pioneer, MSSP, and Next Generation), CMS has used historical control groups against which to measure ACO success or failure. CMS constructs these control groups first by assigning Medicare beneficiaries to ACOs based on which primary care doctors Medicare beneficiaries saw during a three-year look-period, that is, the three years preceding the performance year. CMS then calculates the expenditures on these assignees during the look-back period and, after making several adjustments including building in an increase to reflect inflation during the performance year, sets a target for the performance year. Thus, the assignees during the three-year look-back period serve as the controls for the performance year.

The critics of CMS’s method allege that CMS’s historical controls don’t adjust ACO performance to take account of confounding factors as well as concurrent control groups would. Why this should be so is never explained clearly. Both forms of controls have advantages and disadvantages. The estimates derived with the use of concurrent controls may be inferior because the construction of concurrent controls introduces serious confounding factors which are not introduced by historical controls and which are difficult to measure accurately. The most serious of these is the necessity of changing the pool of beneficiaries who were in the ACOs during the time period studied. McWilliams, for example, altered the real-world pool of ACO assignees (the experimental group) by making up his own assignment algorithm – an algorithm that differs substantially from the one CMS uses.

A second serious defect in concurrent-control studies is their use of CMS’s real-world shared savings payments to ACOs to calculate the net savings or losses. What is the logic of calculating gross savings or losses using a pool of assignees that was different from the real-world pool, and then using only the real-world data on CMS payments to ACOs to calculate the net?

[3] The 2 percent figure for ACO overhead (the percent of Part A and Part B spending attributed to an ACO that is eaten up by the cost of administering the ACO) has appeared in at least two MedPAC documents – the transcript of the September 11, 2014 MedPAC meeting, and MedPAC’s June 2018 report to Congress.

According to the transcript of the September 2014 meeting, then-commissioner David Nerenz asked MedPAC staffer Jeff Stensland if “we know anything about” ACO “overhead.” Stensland replied, “[P]eople we talk to and the data we have seen, it looks like maybe 1 to 2 percent of your spend, that that’s what they’re spending on their ACO to operate it….” (p 133). Stensland concluded, “[I]f you averaged everybody [that is, all ACOs] … the share of savings … that they get is going to be less than their administrative costs….” (p. 144)

MedPAC’s June 2018 report to Congress stated: “Our discussions with ACOs suggest their administrative costs, in contrast to those of MA plans, are close to $200 per beneficiary per year,” or about 2 percent of the $10,000 it costs Medicare to cover Part A and Part B expenses.

But judging from the way the June 2018 report described “administrative costs,” that 2 percent estimate is way below total ACO overhead – administrative costs plus the costs ACOs incur to finance the interventions they hope will reduce Medicare spending. Here’s how the June 2018 report described administrative costs: “ACOs do not have the costs of advertising, enrolling, negotiating contracts, and paying claims. Their administrative costs include the expense of setting up and managing the ACO, which should include data analysis and reporting quality measures.” (p. 236) That definition obviously excludes other ACO-related costs, notably the cost of services delivered directly to patients that are supposed to reduce billable Medicare services. These additional services require hiring new staff, such as nurses and social workers and cab drivers, or changing the job descriptions of existing staff.

What might those additional services cost? Again, we have almost no information. We get some idea of how extensive, and expensive, these services can be by examining a list of such services provided by Partners Healthcare Systems’ ACO (the second-largest of the 32 original Pioneer ACOs) to 4,000 of its sicker assignees. I extracted the list below from RTI International’s 2010 evaluation of Partners’ “care management program” (CMP). According to a 2017 report by John Hsu et al., that program constituted most of the interventions Partners’ ACO financed in its futile attempt to save money for Medicare. Here is the list:

- “Eleven nurse case managers [each of whom worked with about 200 patients] who received guidance from the program leadership and support from the project manager, an administrative assistant, and a community resources specialist” (p. 7);

- “a social worker to assess the mental health needs of CMP participants” (p. 6);

- “a mental health team director, clinical social worker, two psychiatric social workers, and a forensic clinical specialist (M.D./J.D.), who follows highly complex patients with issues such as legal issues, guardianship and substance abuse” (p. 10);

- “a pharmacist to review the appropriateness of medication regimens” (p. 6);

- “home delivery of medications five days per week” (p. 7);

- “a nurse who specialized in end-of-life-care issues” (p. 7);

- “a patient financial counselor who provided support for all insurance related issues” (p. 7);

- “The clinical team leader provided oversight and supervision of case managers” (p. 8);

- “The medical director provided oversight and day to day management of MGH’s [Massachusetts General Hospital’s] CMP….” (p. 8);

- “MGH developed a series of clinical dashboards using data from the MGH electronic medical record …, claims data, and its enrollment tracking database” (p. 8);

- “MGH provided [200] physicians with a $150 financial incentive per patient per year to help cover the cost of physician time for [CMP-related] activities” (p. 8);

- “a designated case manager position to work specifically on post discharge assessments to enhance transitional care monitoring” (p. 9);”

- “a data analytics team to develop and strengthen program’s reporting capabilities” (p. 10); and

- numerous housing, transportation and other “support services” and “community services” (p. 6) that RTI described only vaguely.

Categories: Uncategorized

I’m curious

Does CMS penalize physicians who do not join an ACO?

I would think that physicians would balk not only at the intricacies of CMS payment rules but also at the broader impact – for the privilege of seeing Medicare patients, not only are payment amounts dictated, but so too is the practice environment – ACO. Then again I recall being somewhat stunned when, during the run-up to Medicare PartD, the head of PhRMA (who was at the time the CEO of JNJ), stated he thought Part D was a good thing for manufacturers.

Once the camel has his nose under the tent . . . it’s only a matter of time before he is spitting in your bean curd.

Agreed.

It seems to me as if medical schools are delivering graduates more concerned, relative to historical trends, with the business of medicine than of practicing medicine and seeing, treating, and advocating for patients health and healthcare.

As far as a crisis is concerned – laser like focus on drug prices is creating somewhat of a contrived crisis when a more thorough review of the US Healthcare System would reveal that systemic problems exist largely due to market response to ill conceived, short-sighted, piecemeal government legislation and bureaucratic (and sometimes legal) interpretation and guidance regarding the contents of the Federal Register.

Kip, thanks for your fine education. We appreciate it. For things to change in health care, we might be in the sorry state where we need funerals. The docs are also changing, as medicak schools deliver people who are meek, accepting and peaceful. No one in the trenches hardly discusses what is going on in Washington DC. We have given up. What happens next, as entropy increases, is that we are going to see professionals who miss diagnoses, can’t keep up with the science, and who are no longer excited and fighting for their patients. I ask my colleagues: “What is a group purchasing organization and why are they sending our CEO kickback money? “ No reply.

The policy folks will get the health care they deserve. I’m afraid we need a crisis that we shan’t waste this next and last time.