By JEFF GOLDSMITH

Years ago, the largest living thing in the world was thought to be the blue whale. Then someone discovered that the largest living thing in the world was actually the 106 acre, 47 thousand tree Pando aspen grove in central Utah, which genetic testing revealed to be a single organism. With its enormous network of underground roots and symbiotic relationship with a vast ecosystem of fungi, that aspen grove is a great metaphor for UnitedHealth Group. United, whose revenues amount to more than 8% of the US health system, is the largest healthcare enterprise in the world. The root system of UHG is a vast and poorly understood subsidiary called Optum.

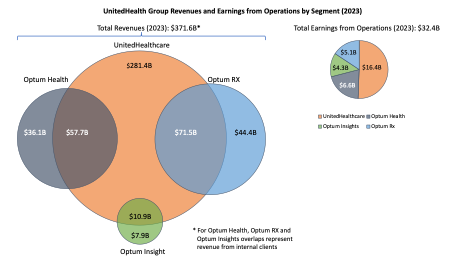

At $226 billion annual revenues, Optum is the largest healthcare business in the US that no-one knows anything about. Optum by itself has revenues that are a little less than 5% of total US healthcare spending. An ill-starred Optum subsidiary, Change Healthcare, which suffered a catastrophic $100 billion cyberattack on February 21, 2024 that put most of the US health system on life support, put its parent company Optum in the headlines.

But Change Healthcare is a tiny (less than 2%) piece of this vast new (less than twenty years old) healthcare enterprise. If it were freestanding, Optum would be the 12th largest company in the US: identical in size to Costco and slightly larger than Microsoft. Optum’s topline revenues are almost four times larger than HCA, the nation’s largest hospital company, one third larger than the entirety of Elevance, United’s most significant health plan competitor, and more than double the size of Kaiser Permanente.

If there really were economies of scale in healthcare, they would mean that care was of demonstrably better value provided by vast enterprises like Optum/United than in more fragmented, smaller, or less integrated alternatives. It is not clear that it is. If value does not reach patients and physicians in ways that matter to them—in better, less expensive, and more responsive care, in improved health or in a less hassled and more fulfilling practice—ultimately the care system as well as United will suffer.

What is Optum?

Optum is a diversified health services, financing and business intelligence subsidiary of aptly named UnitedHealth Group. It provides health services, purchases drugs on behalf of United’s health plan, and provides consulting, logistical support (e.g. claims management and IT enablement) and business intelligence services to United’s health plan business, as well as to United’s competitors.

Of Optum’s $226 billion topline, $136.4 billion (or 60% of its total revenues) represent clinical and business services provided to United’s Health Insurance business. Corporate UnitedHealth Group, Optum included, generated $29 billion in cashflow in 23, and $118.3 billion since 2019. United channeled almost $52 billion of that cash into buying health-related businesses, nearly all of which end up housed inside Optum.

For most of the past decade, Optum has been driving force of incremental profit growth for United. Optum’s operating profits grew from $6.7 billion in 2017 (34% of UHG total) to $15.9 billion in 2023 (55% of total). However, the two most profitable pieces of Optum by operating margin—Optum Health and Optum Insight—have seen their operating margins fall by one third in just four years. The slowing of Optum’s profitability is a huge challenge for United.

Gaul Had Three Parts, So Does Optum

The largest and least profitable (by percent margin) piece of Optum is its giant Pharmacy Benefit Manager, Optum Rx, the third largest PBM in the US.

Continue reading…