By MATTHEW HOLT and INDU SUBAIYA

Indu & I have been talking about Flipping the Stack in health care for about 3 years. 2 years ago we wrote an article for a general hospital audience which appeared in the 2019 AHA SHSMD Futurescan magazine. I was talking about the changes in home monitoring that might come about due to COVID-19 and remembered this article. The one that got published went through a staid editing process. This is the original version that I wrote before which was rather more fun and hasn’t seen the light of day. Until now. Take a look and remember it is 2 years old–Matthew Holt

Over the past twenty-five years most businesses have been revolutionized by the easy availability of cloud and mobile-based computing systems. These technologies have placed power and access into the hands of employees and customers, which in turn has created huge shifts in how transactions get done. Now the companies with the highest market value are both the drivers of and beneficiaries of this transition, notably Apple, Facebook, Amazon and Alphabet (Google), as well as their international rivals like Samsung, Baidu, Tencent and Alibaba. Everyone uses their products every day, and the impact on our lives have been remarkable. Of course, this also impacts how businesses of all types are organized.

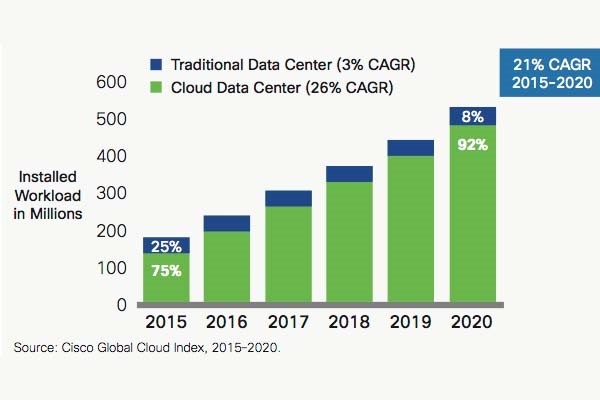

Underpinning this transformation has been a change from enterprise-specific software to generic cloud-based services—sometimes called SMAC (Social/Sensors/Mobile/Analytics/Cloud). Applications such as data storage, sales management, email and the hardware they ran on were put into enterprises during the 80s and 90s in the client-server era (dominated by Intel and Microsoft). These have now migrated to cloud-based, on-demand services.

Twenty years ago the web was still a curiosity for most organizations. But consumers flocked to these online services and in recent years businesses followed, using GSuite, AWS (Amazon Web Services), Salesforce, Slack and countless other services. Those technologies in turn enabled the growth of whole new types of businesses changing sectors like transportation (Uber), entertainment (Netflix), lodging (AirBnB) and more.

What about the hospital?

Hospitals and health systems were late comers to the enterprise technology game, even to client-server. In the 2000’s and 2010’s, mostly in response to the HITECH Act, hospitals added electronic medical records to their other information systems. The majority of these were client-server based and enterprise-specific. Even if they are cloud-based, they tend to be hosted in the private cloud environment of the dominant vendors like Epic and Cerner. Of the major EMR vendors only Athenahealth had an explicit cloud-only strategy, and its influence has been largely limited to revenue cycle management on the outpatient side.

However, the hospital sector is likely to move towards the trend of using the cloud seen in other businesses.

Current technology vendors including Epic and Cerner are beginning to open their systems, and at least moving to private cloud, while another large vendor, Allscripts, has put most of its technology onto Microsoft’s public cloud (Azure). In addition, all the major EMR vendors have adopted the FHIR standard and SMART on FHIR protocols which make it much easier to move data between different applications and to give users a choice of tools, many of which are hosted on the cloud. These standards, as well as products from newer breeds of middleware brokers such as Redox and Sansoro, are allowing smaller companies to develop and sell workflow tools to providers, clinicians and patients.

- FHIR (Fast Health Interoperability Resources) is a set of standardized frameworks built around the concept of standardized data elements and “resources” — modular components built using modern web programming languages. The resources define common data elements, so data can be easily moved form one system to another.

- SMART on FHIR is a protocol that allows applications to be launched from within other applications (usually an EMR) so that a user (e.g. a clinician) can launch a new tool bringing the data from the EMR with them. One example we’ve shown at Health 2.0 is a pharmacist launching the Meducation app within the Cerner EMR. One hint of the business complexities SMART on FHIR might cause is that Meducation is owned by drug information company First Databank whose main rival is Multum—owned by Cerner.

How quickly is FHIR being adopted? In the SHSMD survey only 8% of hospital executives said their organizations were already using FHIR to make it easier for 3rd party applications to access their data, with 29% saying they were very likely to do so and 24% saying it’s mostly likely they would. Our guess is that these numbers understate FHIR’s impact. Bear in mind this standard is already being used by Apple to extract data for its health record from 90 top hospitals. In addition, all major EMR vendors and many major health systems are developing a series of partnerships, apps stores and innovation programs to allow those 3rd party application vendors easier access to users (clinicians, patients, administrators). And many hospitals (including Mount Sinai, Providence St Joseph and more) are of course contributing to the explosion in apps and services by encouraging their internal teams to create them.

It is early days for this transformation. Most clinical organizations are still using a single vendor, but over time the three main layers of tech functionality—data storage, transactions and user interface are starting to break apart, allowing different players and different technologies to be plugged into various parts of the enterprise. For example, there’s been dramatic growth in third-party telemedicine services like Vidyo or Aviza integrating with the EMR. Similarly a new class of tools are using APIs to plug into the EMR, like Gauss Surgical which tracks blood loss in the OR using an iPad. In addition, there’s now a layer of separate companies providing data exchange and another providing data analytics in the cloud. In other words the tech stack is itself decentralizing and breaking up.

There’s considerable debate within the health tech community as to the near-term evolution of the hospital tech environment. Most hospitals have spent huge amounts on EMR installations in recent years which would tend to argue against many of them performing a “rip and replace” on their incumbent vendors. But while the transaction layer inside the current EMR (e.g. for orders and clinical documentation) would look to be well embedded in the system, new types of interface, storage and data analytics are increasingly being trialed.

The advent of FHIR, APIs and distributed storage certainly portends a future of decentralized data and decentralized services. That has big implications for organizations like health systems that are trying to combine physical and contractual controls over their data and services.

As advancements in technology continue to revolutionize health care, leaders in the field are preparing for the next wave of change and how it will impact hospitals and health systems and the communities they serve.

At the forefront are AI), VR, AR and blockchain – all built on the expanding capabilities of cloud computing and driven by the burgeoning Internet of Things.

Blockchain

Blockchain is a distributed database technology in which every transaction is recorded on every node in a network, and therefore very hard to hack or alter. Blockchain also does more than just record transactions. It allows the embedding of “Smart Contracts” within the blockchain which enables permissions, allows and points access to data and performs transactions – all automatically. Closely related is the concept of “identity by consensus” which enables the authorization of identity from data gathered from multiple sources of information.

It is extremely early days in blockchain. There are one or two industry groups forming in health care (such as the Linux Foundation’s Hyperledger Consortium and Hashed Health). In a recent survey 75% of health care executives say their understanding of blockchain is “excellent,” while 39% say it’s in their top 5 priorities. In the Deloitte survey 11% of health care executives reported deploying blockchain somewhere in their enterprise, the SHSMD survey of hospital executives for this publication had a much more stringent question. When asked if “their organization would change most of its data storage and transactions tools to blockchain or other distributed computing technologies”, 6% said it was already happening, while another 24% said it was very likely.

The only thing being hyped more than blockchain is Artificial intelligence (AI). Virtually anyone who can run an Excel macro now claims to have an AI product, and at the other end of the spectrum techno-optimists are looking to merge their brains with machines and achieve the singularity. But at its core AI is enabling very quick computation of vast amounts of data looking for patterns, and making suggestions about them (i.e. in Radiology, symptom assessment) and in some cases acting on those patterns (self-driving cars, robotic surgery). Perhaps the most promising area for AI is in computations that are just far too complex for humans, such as identifying the factors behind cancer or managing and matching complex drug regimens with genomic and phenotypes.

Examples of just a few companies using AI for complex tasks in health care

- Prognos –Use lab, medical and claims data to predict patient disease onset

- SurveyorHealth—Personalizes complex drug regimens to lower risk and improve outcomes

- Babylon Health—Chatbot front end, takes symptoms and delivers diagnoses

While the worlds of gaming and entertainment are already being changed by VR and AR, it’s a little harder to see where these fit in in health. So far, VR is being experimented with in pain management and mental health. AR seems to be finding its niche in remotely recording and supporting patient physician visits andoverlaying X-ray images on patients to aid in clinical precision.

- Augmented Reality superimposes a computer-generated image or data over a view into the real world using a device that a user can see through such as Microsoft Hololens or Google glass

- Virtual Reality places the user in a completely artificial world using a system of headsets, (such as Oculus Rift or the HTC Vive) controllers and gloves. (end of box)

But the biggest part of the AI, AR, and VR revolution is likely to come with the combination of these trends with the underlying technologies of sensors, analytics and on-demand computing. The early stages of this is playing out in kitchens and living rooms across the world filled with kids demanding that Alexa play some annoying teeny bop song while their parents desperately try to tell it to shut up. But voice-controlled and automatically-controlled systems will soon both be responding to human instructions and predicting them. Already some companies like Aiva are putting Alexa in hospital rooms to replace nurse call systems, which enable two way communication. Soon more and more of this will be automated, and the sensors will not only be taking instruction but also be passively tracking patient activity in the hospital and in the home, and automatically responding.

The role of the Tech Giants

It has escaped few observers’ attention that the companies with the most advanced technology in AI, voice recognition, sensors and cloud computing are the same ones which have benefitted from the SMAC revolution. Concurrently the health tech press has been abuzz with articles reading the tea leaves about what Amazon, Apple and Alphabet/Google will do in health care.

For this publication the SHSMD survey asked hospital executives if a major technology company, such as Google, Amazon, or Apple, would emerge as a significant developer of health care services that competes directly with their organization’s services. 9% said this was already happening (again that might be a surprise to the tech giants) but another 38% said it was very likely.

No one (probably including the tech giants themselves) has a really clear view of what they are doing and what adding services and applications to their massive technology reach among consumers could do. But clearly any of these companies has the balance sheet enabling them to do anything they like in health care. In addition, other major players such as CVS (which is currently buying Aetna), Walmart (rumored to be buying Humana), and United HealthGroup (which has bought several large physician groups) are not sitting still. It seems that all of them are angling in on the chronically ill consumer in the home. This is of course a patient population and location with which traditional health care systems have struggled.

Sleuthing the tech giants’ health care moves

- Apple seems focused on sensors. Looking at its acquisitions, hiring and patent applications, the best guess is that Apple is focusing on tracking bodily functions related to diabetes, heart disease, sleep and using the Apple Watch as a core device. It’s also created an integration of EMRs from over 90 hospitals which can bring data into its app store, and is creating its own medical clinics.

- Amazon is clearly getting into hospitals supplies, and recently bought PillPack, a pharmacy specializing in home delivery for those on multiple medications. In addition, it also has the biggest cloud service in AWS and its Alexa currently dominates the smart speaker market which is already in 20% of homes. That suggests that it’s targeting the chronically ill at home.

- Alphabet also has its cloud service (Google Cloud) which has 30+ health tech companies on its app store while it has placed many bets in its Verily unit on genomics & personalized medicine. In addition it has a $500m joint venture with Sanofi called Onduo working on diabetes care, and it just bought 10% of Oscar Health, a new style insurance company.

Inverting the stack

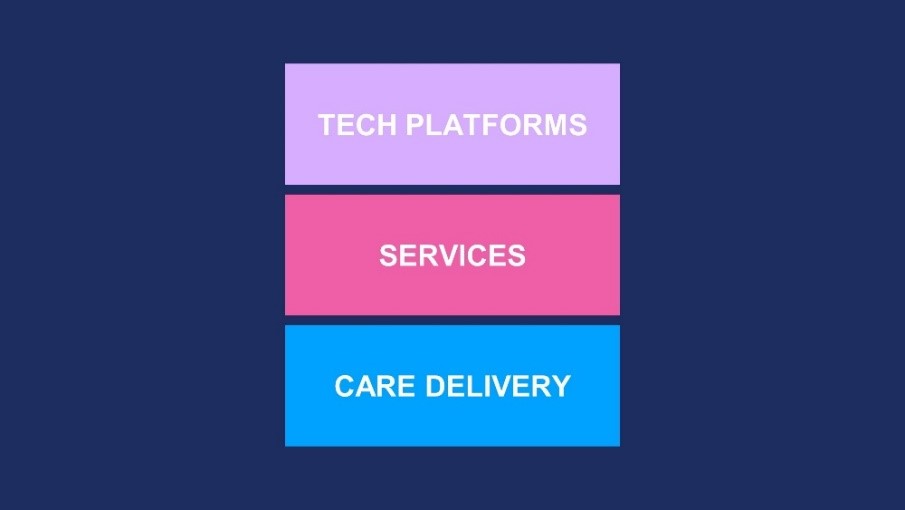

There are several obvious scenarios in which new market entrants can change health care but the one in which they take a major role we call “Tech inverting the stack”

Traditionally care delivery from clinicians was (and is) the basis for health care—the office visit, the hospital admission. Then services were added (think phone support from nurses). Finally, technology was deployed to track and bill for it. Facilities and organizations were designed around the processes and staff required to carry this out.

Imagine this triple layer being inverted. Starting with technology, the sensors, trackers, AI systems and processes are soon going to be in place monitoring, measuring and suggesting next steps to both providers and patients. In general, this will move health care from being an event driven system to becoming a consistent process. Theoretically “normal’ patient behavior and activity will not need any response, whereas exceptions and problems will require intervention from a combination of human and machine services. Finally, care delivery – the clinical interventions that make up health care are we know it today – will become an added extra to the top of the health care stack. In fact almost any clinical intervention could be thought of as a failure of the system, or at least a correction to “auto-pilot” mode.

What might this inverted stack look like? You can imagine a combination of at home delivery of medication and more (Pillpack), combined with internet of things sensors (Apple) plus technology-based services companies monitoring chronically ill patients (Livongo) or connecting them to online doctors (Doctors on Demand) or even supplying them the full hospital experience (Medically Home). In this scenario, the tech platform is the underlying system, with services and professionals on top. There’s no real reason to think it can’t be done, and there’s no reason to suppose that if it is done it won’t radically reduce doctor visits and hospital admissions, and improve patient care.

Conclusion & Implications

As with any analysis of technology promising “disruption”, the careful reader needs to ask themselves one primary question. Is this change real? Or is this just another PowerPoint from a futurist that will be brushed off by the “mother of all adaptive systems”?

The technology trends we have described are already in motion. The question is, how big their impact will be in health care? And how long will it take? Here are a few suggestions for hospitals executives to help them understand the transition and assess the rate of change.

- Get familiar with the technologies. You won’t understand VR by reading this piece. You might if you play a video game with your kids on their new Oculus headset.

- Follow the pilots in your organization and other organizations using these new tools. They’re happening everywhere (we promise!). Talk to the end users, talk to the patients, ask for real data on cost and impact.

- Spend time with health tech startups at conferences, volunteer as a mentor at an incubators, got to health tech meetups, seek them out online. Get to know the young cutting edge techie doctors in your AMC hiding out in their labs. They’ll be pushing the boundaries of what can be done. They may not seem realistic now but you’ll get a sense of the possible

- Pay attention to both leading edge payers (like Oscar Health, or any employer who uses Grand Rounds) and CMS. The more payment for value becomes real, the more likely it is that real changes in how chronically ill patients are monitored and managed will take effect.

If you read this piece and you googled most of the company names other than Google, then hopefully it’s been helpful. If you didn’t need to, then your organization is probably putting the right environment in place to adapt to these technologies.

Matthew Holt is Founder of THCB & Co-Founder, Health 2.0. Indu Subaiya is co-founder, Health 2.0 & CEO of Catalyst @ Health 2.0

Categories: Health Tech, Matthew Holt

The problem with health care and any new technology additions/interaction is the cost of services never goes down, access never goes up, and the health of citizens never really improves. We can “treat” disease but we aren’t lowering it. This has come glaringly visible during Covid-19 as we see poor and/or black Americans getting the disease in larger proportions than their general population distribution.

Who’s paying the deductibles and copays for someone who spends multiple weeks in ICU with maybe a week or two on a vent. Who’s compensating for the use up of lifetime maximums?

Technology never confronts this and the health system wants to ignore it to maintain the their for profit status quo