Last week, HHS issued its much-anticipated report about the first wave of enrollees in the state and federal health exchanges. Its release coincided with the 32nd Annual J P Morgan Healthcare Conference in San Francisco, arguably Woodstock for health care investors.

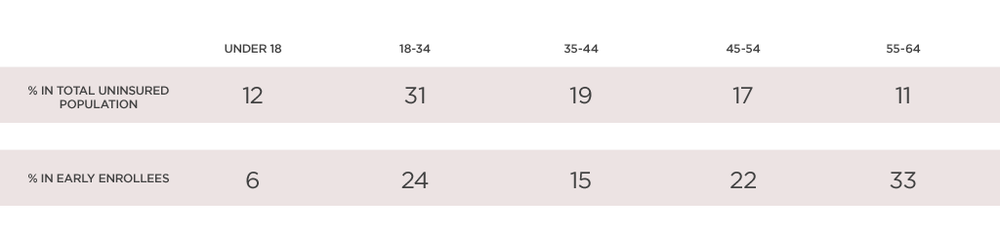

HHS reported that, as of December 28, 2.2 million signed up for coverage. They are older and probably sicker than the overall population of 50 million uninsured in the U.S.:

Per the analysis, 54% of these are female, 71% are eligible for financial assistance and most signed up for silver plans (60%) vs. the more expensive platinum (7%) and gold (13%) or the less costly bronze (1%) options.

The 14 states run exchanges fared well in the first 90 days accounting for 956,991 enrollees—most in blue states where governors were supportive of the exchange effort. In fact, 10 exceeded their enrollment target even though the national target fell 1.1 million short.

Front-page headlines about the report marked its significance: “Health Sign Ups Skew Older, Raising Fears of Higher Costs” (Wall Street Journal Louise Radnofsky and Christopher Weaver) and “Older People Lead Sign Ups for Insurance: Pattern Could Result in Higher Premiums”(New York Times Michael Shear and Robert Pear). But to the company executives and investors in San Francisco, the story was less important. Bigger issues and opportunities were their focus, with decidedly different outlooks contrasting two of the most important sectors in the industry.

Private health insurers are bullish: Health plan executives are optimistic about their future. They are betting on growth via acquisition of smaller plans, expanding risk sharing arrangements with providers, monetizing data as health informediaries, opportunistic partnerships in global markets, and increased enrollment for their individual and government sponsored plans. So the HHS report was dismissed as “we told you so” with guarded optimism expanded enrollment via working exchanges will come later.

Hospitals and integrated health systems are bearish: By contrast, executives from investor owned and not for profit health systems and integrated networks are bears. Cutting operating costs is their highest priority to offset lower rates from Medicare, Medicaid, and private insurers. Capital commitments to information technologies, physician integration and outpatient services are forcing tough choices about their clinical programs. Like plans, most are pursuing growth: affiliations, diversification into retail health and population health management top their lists.

But for providers in the high stakes game of acute and sub-acute services, the harsh reality of declining margins and extraordinary pressure from physicians and payers is front of mind. Notably, investors and lenders place high value on effective management in this sector, given its volatility and risk. And growing demand for its services and facilities means future profit for investors who can spot strong management teams and scalable business models. Like health plans, the HHS report was taken as another piece in the complicated puzzle called health reform. But enrollment in health exchanges is not their biggest concern. There are bigger issues and opportunities.

What struck me most about San Francisco is the voracious appetite for health care investing. Granted, the U.S. health care industry is big, fragmented, highly regulated inefficient, and capital-dependent. But in each of the past 35 years, total spending has grown at 2.4% above the national GDP so it remains a strong favorite for investors.

So the HHS enrollment report garnered front-page coverage but the leading executives in the industry are not preoccupied with health exchange enrollment. They know it’s go big or get out, but it’s not business as usual. And investors are prepared to fund those able to deliver results.

Paul Keckley, PhD is an independent health care industry analyst, policy expert and entrepreneur. Keckley most recently served as Executive Director of the Deloitte Center for Health Solutions and currently serves on the boards of the Ohio State University Medical Center, Healthcare Financial Management Leadership Council, and Lipscomb University College of Pharmacy. He is member of the Health Executive Network and advisor to the Bipartisan Policy Center in Washington DC. Keckley writes a weekly health reform newsletter, The Keckley Report, where this post originally appeared.

Categories: The Business of Health Care