By UWE REINHARDT

One of the greatest pleasures of running THCB has been to get to know and host the writings of some of my health policy heroes. This week I have already published work from Jeff Goldsmith, and Ian Morrison & Michael Millenson among others will be featured next week (as the party won’t quite stop). Perhaps one of the most amazing things was that the doyen of health economists, Uwe Reinhardt, offered to write some original pieces for THCB…prodded by former editor John Irvine. This is one of my favorites, riffing on a talk I heard him give in (I think) 1993 about how HCFA was like the Kremlin and how free market Reaganite Republicans had made it so. This piece is from Jan 2017 and Uwe sadly died that November.–Matthew Holt

Although, unlike most other nations, the U.S. has only two parties worth the name, their professed doctrines compared with their actions strikes me as more confusing than the well-known Slutsky Decomposition which, as everyone knows, can be derived simply from a straightforward application of Kramer’s rule to a matrix of second partial derivatives of a multivariable demand function.

The leaders of the drug industry, for example, probably are now breaking out the champagne in the soothing belief that their aggressive pricing policies for even old drugs are safe for at least the next eight years from the allegedly fearsome, regulation-prone, price-controlling Democrats. My advice to them is: Cool it! Follow me through a brief history of Republican health policy, to learn what Republicans will do to the health-care sector when it ticks them off.

Republicans like to tar Democrats over allegedly socialist policy instruments such as price controls, global budgets and deficit-financed government spending. Democrats usually roll over to take that abuse, almost like hanging onto their posteriors signs that says “Kick me.” I say “abuse,” because Republicans have never shied away from using the Democrats’ allegedly left-wing tactics when health care chews up their budgets or turns voters against them.

Think of the early 1970s. Like most other economies in the world, the U.S. economy then suffered very high inflation, led by health spending widely judged to be out of control. So Republican President Richard Nixon thought nothing of slapping price controls onto the entire U.S. economy, keeping them longest on the health care sector. (I cannot imagine Democrats ever having the guts to do that or, for that matter, to sojourn to China, there to pay court to Mao Tse Tung, the self-anointed Communist Emperor of the Middle Kingdom).

Think of the 1980s. Ticked off by the ever increasing grab for taxpayers’ money triggered by Medicare’s retrospective reimbursement of hospitals then in place, Republican President Ronald Reagan thought nothing of slapping onto that sector a set of centrally administered Medicare prices for the whole country. That new pricing scheme, based on the Diagnosis Related Groupings (DRGs), reminds one of nothing so much as Soviet style pricing, to cite the mournful, subsequent mea culpa of one of the former bureaucrats tasked with implementing that system between 1983 and 1986.

I recall making in the early 1990s a presentation to the Missouri Hospital Association, where I opened up with the following slide:

(I actually wore that uniform at the podium. I had been bought by my wife, in 1989, from a Russian at the Brandenburg Gate in Berlin, immediately after the fall of the Berlin Wall. The photo was taken in 1990 by our son Mark, at the tank museum of the Aberdeen Proving Grounds in Maryland, before a WWII Russian T-62 tank.)

Evidently enchanted by the price-controlling, cost-containment power of President Reagan’s Soviet pricing scheme for hospitals, President George Herbert Walker Bush imposed, in 1992, a similar scheme on physicians treating Medicare patients. Known as Medicare Fee Schedule (MFS), it was based on the Resource-Based Relative Value Scale (RBRVS), a pseudo-scientific design that seeks to base relative Medicare fees for particular services on their relative cost of production. A problem with that approach, of course, is that relative costs do not coincide with relative values. It would set the fees for, say, a hypothetical transurethral tonsillectomy as much higher than that of the traditional transoral one, simply because the transurethral approach is more time consuming.

Anticipating that physicians would game the new Medicare Fee Schedule by responding to lowered fees with commensurate increases in the volume of services recommended and delivered to patients, the Bush Sr. Administration coupled the new fee schedule with Volume Performance Standards (VPS), a fancy euphemism for nationwide global budgets, one for surgical and the other for non-surgical physician services delivered to Medicare patients. Democrats may dream of global budgets. Republicans do them. That anyone seriously thought a global budget for as large an entity as the entire U.S. could ever work – that it was productive to punish conservatively practicing physicians in Duluth, Minnesota for huge volume increases in Dade Country, Florida — is a testimony to the far reaches of the human mind.

Predictably disenchanted with the non-performance of the Volume Performance Standards, a Republican House in 1997 morphed it into Medicare’s Sustainable Growth Rate (SGR). The SGR became law. It was global budgeting still for the entire nation, but so stringent that Congress dared apply it in only one year, otherwise kicking it down the road unused, for eventual resolution.

That resolution came in 2015, with the so-called “Doc Fix,” the still controversial Medicare Access and CHIP Reauthorization Act (MACRA). That act was sponsored and introduced to the Republican House of Representatives by a Republican Congressman from Texas who is also a physician. It was promptly signed into law by President Obama, after it was passed with a bi-partisan vote in both chambers. The MACRA quite sensibly seeks to establish a direct link between Medicare payments to a physician and the quality of the services delivered by that physician. Alas, once packaged by the bureaucracy into concrete regulations for operation in the trenches, the resulting complexity of measuring quality in practice and even the validity of these operational metrics now predictably has physicians all over the country up in arms.

And so it goes, to plagiarize Kurt Vonnegut.

So it is prudent to wonder just what health policy will come down in the years ahead from the Republican Mount Olympus ruled by President Trump. Republican Presidents, members of Congress and Governors may like playing golf with the leaders of the health-care industry and share a Bourbon or two with them; but they don’t like it when that industry’s endless, energetic search for mammon chews up their budgets, and they do not hesitate to react to that fiscal hemorrhaging with fury, often resorting to the allegedly socialist tactics they usually ascribe to the Democrats.

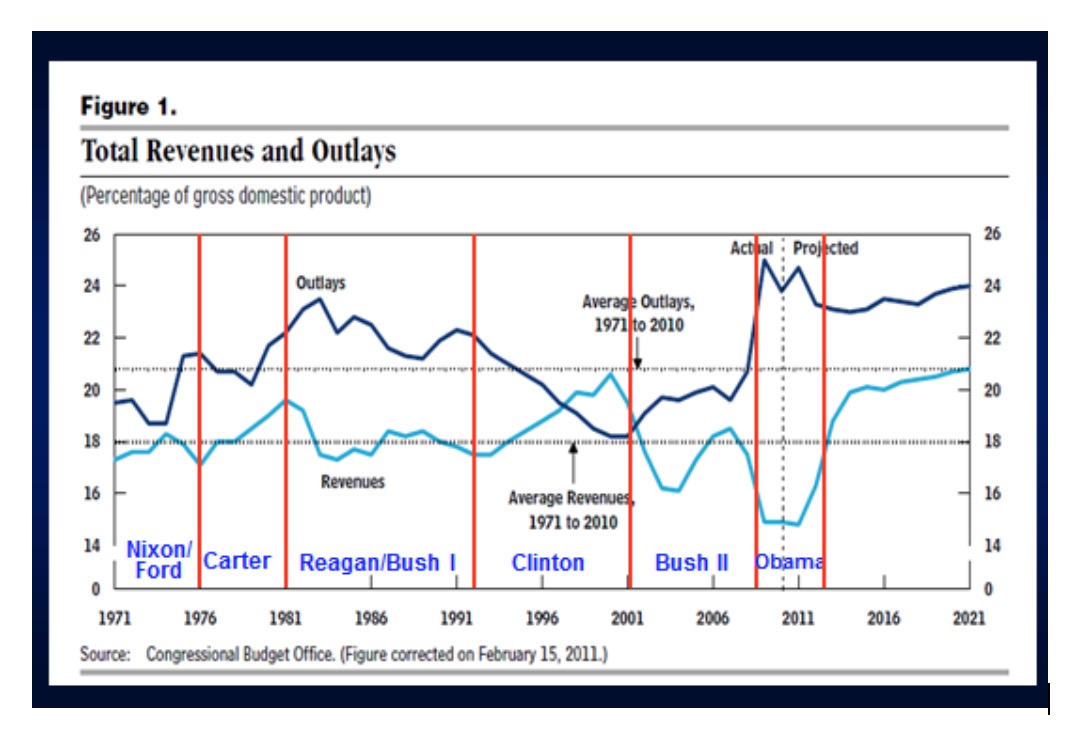

What can be said about health policy also applies to U.S. fiscal policy. Democrats have never been able to shake off the label that they are the party of deficit-financed government spending – that they practice the much maligned, socialist Keynesian economics — in spite of plenty of history to the contrary. Consider, for example, the graph below published by the non-partisan Congressional Budget office (CBO).

The time paths of federal tax revenues and spending clearly show what former Vice President Dick Cheney reportedly explained to an amazed then Secretary of the Treasury Paul O’Neill: “Reagan taught us that deficits don’t matter.”

Deficit financed government spending and tax cuts are usually considered the very core of Keynesian economics, aimed at shoring up the demand side of the economy. It is based on the idea that there is not enough demand to buy the products the supply side could deliver. It is a policy much decried by Republicans and the media supporting them, e.g., The Wall Street Journal or the anchors and talking heads on Fox News TV. It stands in contrast to so-called supply side economics, which seeks to rev up the economy by changing the financial incentives (mainly taxes) and regulatory burden faced by the supply side of the economy, assuming that the barrier to faster economic growth lies on the supply side of the economy.

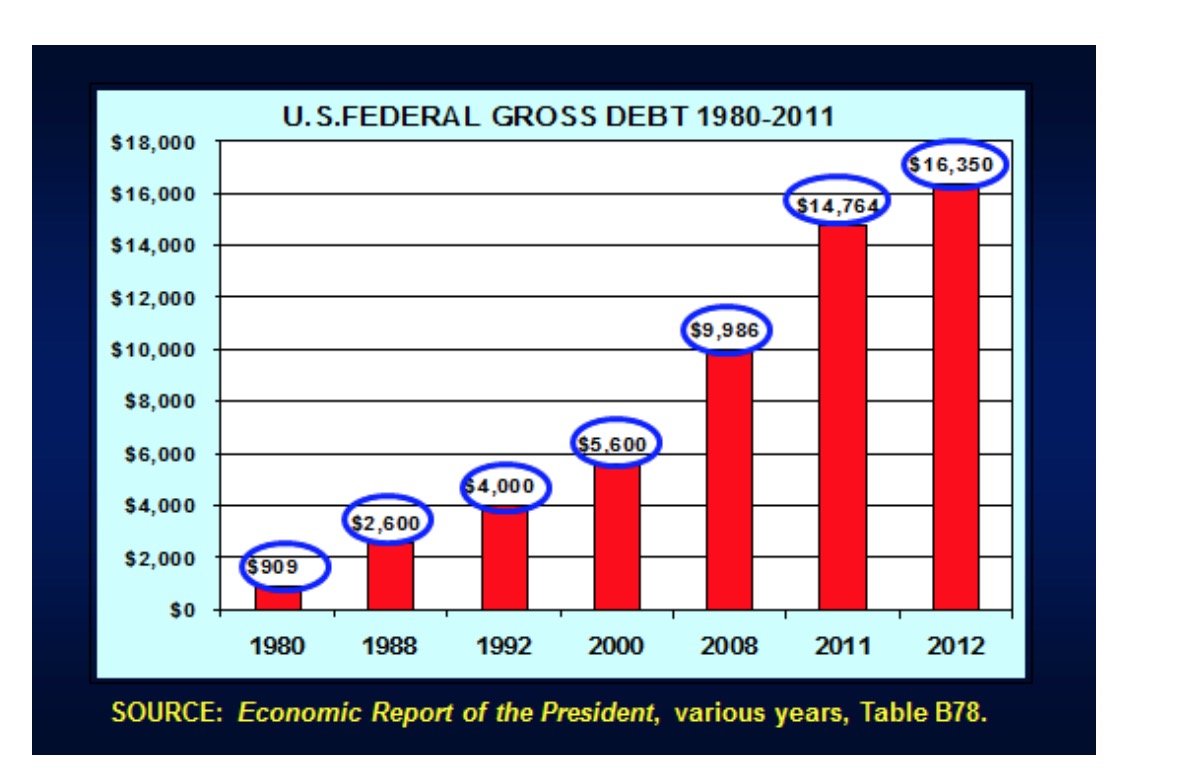

Although during the election campaign in 1980 President Reagan had promised to balance the federal budget by 1984 and rev up the economy just with tax cuts that, through faster economic growth, would be self-financing, in fact his administration coupled the huge cuts in the individual tax rates it got swiftly passed by Congress with huge increases in defense spending and even farm support, driving up federal deficits to levels easily three times as high as the previously much decried, relatively puny deficits registered by President Carter (see chart below). By the end of President Reagan’s eight-year term in office, the public federal debt had tripled. By the time President Bush Sr. left office, it had quadrupled.

Had President Reagan really tried his hand at supply side economics, he would have lowered substantially the corporate tax rate from the statutory level of 35% to closer to 20% or even below, to keep U.S. capital and investments at home. Instead he left the high statutory corporate tax rate in place and even increased the tax take from the corporate sector by closing some loop holes. Reagan’s tax policy – especially his second-term efforts to close loop holes and broaden the tax base — actually seemed to slouch toward policies many Democratic economists would and did support. The point here is that overall, one can fairly argue that Reagan’s fiscal policy slouched much more toward the much maligned Keynesian policy of driving economic growth, rather than to solid supply side economics.

Seemingly paradoxically, corporate executives tend to go along with cuts in individual rather than corporate tax rates. It is so because they all manage two companies: one owned by shareholders, and the other, increasingly large company owned by their families. When given a choice between tax cuts for either or the other of the two entities, they naturally lobby for the second, which is what Republican presidents – Reagan, Bush Sr., Bush Jr. — have always faithfully delivered. We shall see what President Trump will do in that regard.

The CBO graph above also shows the eventual decline in the federal deficit and emergence of a federal budget surplus under Democratic President Clinton (although in fairness it must be said that then House Speaker Newt Gingrich gave him a helping hand). When President George W. Bush ascended to the White House, he actually inherited a federal surplus and the prospect of shrinking public debt. His fiscal policy frittered away both.

President George W. Bush, starting in 2001, basically repeated the rather reckless Reagan strategy of trying to goose the economy through increased government spending coupled with massive cuts in individual income-tax rates, all financed with large deficits and rapid increases in the federal debt. Under his reign the federal public debt rose from $5.6 trillion to close to $10 trillion. With the Medicare Prescription Drug, Improvement and Modernization Act of 2003, he even put a brand new future entitlement – heavily subsidized drug purchases by Medicare recipients – on the federal tab. That even after that action deficit financing of large future entitlements can so easily be hung around the neck of Democrats attests to the political power of the Republican oral tradition.

Finally, the CBO chart clearly shows that it would be unfair to impute the huge budget deficits and run-ups in the federal debt after fiscal 2009 to President Obama. In the wake of the global financial crisis of 2007-2009 – not of either President Bush’s or President Obama’s making — government revenues plummeted and much of the increased spending came from the so-called automatic stabilizers – mainly entitlements such as Medicaid, unemployment compensation, food stamps etc. – long ago baked into federal law. Neither of the two presidents had any control over these trends. Indeed, according to the CBO’s Budget Projections of January 2009 – published before President Obama had moved into the White House – the projected deficit in President Bush’s last budget, submitted in October 2008 for fiscal 2009 (October 2008 to September 2009), was close to $1.2 trillion. Surely that did not conform to the President’s idea of sound fiscal policy.

With this brief historical background, one can just see what might happen to fiscal policy under the reign of President Trump.

My hunch is that, to win a second term, he will heed Vice President Cheney’s dictum and, once again, practice the good old Keynesian economics that the American public loves so much: large tax cuts combined with massive, job-creating increases in federal spending on defense and on infrastructure projects, including, perhaps, sparkling new elementary- and high schools and perhaps even new health-care facilities in inner cities, to own up visibly to the folks living there to whom he had promised help, and all debt financed as good investments to make America grow and great again. Why not?

The alternative, asking the private sector to finance these infrastructure projects, may seem attractive to Republicans at first blush, but one must wonder how folks in the so-called “fly-over” country will react when all of a sudden their hitherto free roads and bridges are converted to toll-charging facilities, with tolls set on Wall Street by rapacious private equity firms beholden only to their equity investors in the US and abroad. It might not be a vote getter.

Keynesian economics has worked well for Republicans, because voters love it, as they seem to get something for nothing, federal debt and future taxpayers be damned. And in a world financial market awash in capital with nothing to do, safe U.S. government bonds will find many eager buyers.

It is all quite confusing, even to a Ph. D., and perhaps especially to a Ph. D., because, as I noted in the introduction, U.S. politics are ever so much more intellectually taxing than is the good old Slutsky Decomposition.

Categories: Health Policy