By MATTHEW HOLT

There’s a lot of strum & dangst about the uptick in system utilization that has boosted hospital profits and hit Humana and United’s bottom line (But not so much Elevance’s). Kevin O’ Leary over at Health Tech Nerds brought this up today and I was reminded of this piece I wrote in 2006. And a big issue was, how much understanding and control do insurers have over the utilization in (and out of) their networks. So take a look at this piece and particularly, given the issues at the BUCAHs and at smaller players like Agilon, consider how much insurers actually know about spending? And remember that Wellpoint was the 1990s name for what is now Elevance, via being called Anthem!–Matthew Holt

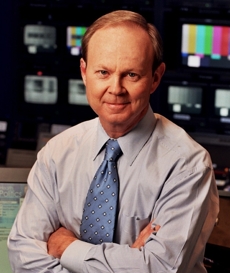

No one is arguing that Len Schaeffer isn’t a very bright guy, nor that he hasn’t done very well in America’s health care system. He’s also done very well out of America’s health care system. So when McKinsey publishes a fawning interview with the man who saved Blue Cross of California, and turned it into one of the most profitable for-profit health insurance companies, and then merged it with the other for-profit Blues, it’s perhaps appropriate to ask a few more questions.

Full disclosure here; in the distant past I’ve worked for several companies that are now part of the Anthem/Wellpoint collosus; and I currently do work for the California Health Care Foundation, which wouldn’t exist were it not for the fact that, when Wellpoint converted to for-profit status, it (and the California Endowment) were endowed with a huge chunk of stock. So you can take my comments in what ever light you like. In addition I’ve only done limited research here and a couple of things are retelling of tales I’ve heard, so if anyone knows more gossip, please email me.

Schaeffer is coming towards the end of his business career, but he started young and fast. He was head of HCFA (the artist now known as CMS) at age 33 in the Carter Administration. Now I call Mark McClellan the boy wonder, but he was 41 when he got the job! After leaving HCFA (before it got really exciting in the early years of the Reagan administration when DRGs were introduced, but being the first to introduce a type of DRG for kidney dialysis), and going via Group Health for a couple of years, he ended up at Blue Cross of California. He got there in the middle of an incredible screw-up.

Blue Cross had set up an HMO to compete with Kaiser called HealthNet. Incredibly enough somehow or other Blue Cross didn’t manage to enforce their formal corporate control over its board members on the board of HealthNet. So the board of HealthNet looked around the room one day, noticed that they might do alright if they were running a for-profit company, and declared independence. More on that story in this court documents. And apparently despite several years in court there was nothing Blue Cross could do. Retroactively Healthnet had to agree to endow a foundation with the state (the California Wellness Foundation) but the amount put into that foundation was a tiny, tiny proportion of HealthNet’s market value.

Schaeffer turned up to steady the ship at Blue Cross in the wake of the Healthnet screwup. In part he did this by turning Blue Cross from a warm and fuzzy non-profit into a pretty avaricious underwriter and a health plan that played very hardball with its providers (and members). More on that in the first section of this document, but it’s a reminder of a tack taken years later by Jack Rowe at Aetna.

But he clearly learned something from the experience. The first thing he did was to set up a for-profit subsidiary called Wellpoint which started buying health plans and offering services (primarily outside California). Then he tried to put all of Blue Cross’ assets into Wellpoint. It looked like he’d away with this for a while, but then started negotiations to take the whole thing for-profit. Apparently when the state first asked him the amount with which he would fund the foundation, his first offer was “nothing”. This eventually got anted-up to $100m. Eventually the state (pressured by consumers’ groups) pointed out that it had quite a bit of control over the Blue Cross plans, and in the end the two Foundations were set up with lots of money and the majority of the stock, which gets spent doing good works in California (and funding some great research!) — not that everyone’s happy with it!

However, what amuses and dismays me is that Schaeffer is lauded for a couple of things, specifically the creation of new insurance plans and the shift to consumer care, and a commitment to IT. I really don’t understand what is so amazing about the new consumer plans, other than the Tonik brand has a lame web sites which look exactly like what a 50 year old thinks a 23yr old thinks is cool. THCB readers already know that, while selling high deductible plans to youngsters may help a 23 yr old who needs catastrophic insurance, you’re not going to fix the problem of uninsurance by replacing it with under-insurance. But underwritten properly, these plans are very profitable for Wellpoint. And Wellpoint is damn good at underwriting.

So much so that you’d be surprised at what Schaeffer says is the main problem with American health care. Practice variation and lack of information:

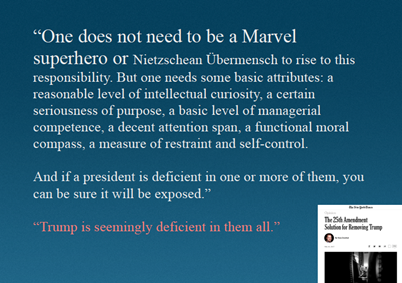

The level of variation in our health care system is unbelievable. You could be hospitalized for nine days in New York and for three days in California with the same diagnosis—and those differences would have no impact on outcomes. There is no other industry in the world that uses so many different approaches to the same thing and in which these differences don’t relate to better results

So can’t health plans fix that? Apparently not:

As a health insurer, if you start by telling doctors, “We know what’s best; we’ll pay you for it,” you violate the fundamental principle that doctors want to exercise their own discretion. That’s what killed HMOs—telling the doctors what to do. Doctors don’t like to follow cookbooks, but, clearly, evidence-based medicine would work better for patients.

So because health plans failed at getting doctors to practice better medicine, instead they’re going to give them the information systems that show the doctors all about this variation, and it’ll magically self-correct. Except there’s the odd problem there too, including more cluelessness by health plans.

Continue reading…