By JEFF GOLDSMITH and ERIC LARSEN

It has been a rough year so far for digital health. After an astonishing $45 billion poured into new digital health companies in 2020 and 2021, and an early 2021 peak in market valuations of publicly-traded digital health providers, valuations and multiples have collapsed. Once high-flying Teladoc, which traded at an eye-watering 42x revenues and commanded a $45 billion market capitalization, is now trading around 2.7X at about $5.7 billion. AmWell, the next largest telehealth player, has seen its stock drop more 90% from its high.

Nor is the evaporation in market value is confined to just a few highly visible incumbents. The 29 healthtech companies to go public (either via IPO or SPAC) in 2021 were collectively trading 45% lower than their opening day price by the end of the year, according to STAT. Among the privately held firms, re-valuation of digital health is getting underway. Bearish market signals portend a sharp correction in digital health, characterized by brutal price competition, widening (and less tolerated) operating losses, layoffs, and ultimately, widespread consolidation.

However, there is also major pushback from the ‘demand side’ of the digital health equation. With the explosion of digital health players, potential customers are confused and frustrated. There is a fundamental disconnect between the exuberant (and as yet largely unsubstantiated) promises of digital health startups and the needs of the four ‘phenotypes’ of health care customers. How digital health firms respond to those customers’ needs will ultimately determine the shape and size of the digital health market.

Why is the Digital Health Market Correcting?

Let’s start with the supply side. It is not difficult to identify the source of the digital health boom: hyper liquidity in the market fueled by expansive COVID-related fiscal and monetary policy. In the heat of COVID, Congress enacted three enormous stimulus/relief packages in eighteen months. The Federal Reserve also turned deeply dovish, keeping interest rates near zero and embracing epic quantitative easing – pumping $120 billion a month into the economy and expanding its balance sheet by more than $6 trillion. Much of this newly printed cash found its way into the coffers of private investors. Private equity, growth equity, and venture capital collectively raised $733 billion in new capital across 2021. Globally, private equity firms alone invested $151 billion in healthcare in 2021.

Telehealth Ignition

The spark to ignite the digital health explosion came from the surprise growth in telehealth visits in the spring of 2020. In the wake of the spring 2020 lockdown and freeze on elective hospital care that accompanied the COVID public health emergency, telehealth visits went from less than 1% of total Medicare Part B patient visits in 2019 to nearly 13% during the spring of 2020 (and nearly 38% of all behavioral health visits), according to an analysis by DHHS’s ASPE. Private insurers saw 50-70% of behavioral health visits turn virtual.

This surge was not caused by a spontaneous surge of consumer activism but rather by hospital systems desperate to remain in touch with existing patients during the spring COVID lockdown. These systems saw plummeting visit volumes not only due to service closures but to patient reluctance to visit hospital ERs and outpatient clinics crowded with contagious COVID patients. Larger systems with extensive IT infrastructure were able to stand up far more robust telehealth offerings than smaller systems. As Bob Wachter, Chair of Medicine at University of California at San Francisco said, “We made 20 years’ worth of progress in twenty days.”

The sudden multi-thousand percent rise in telehealth volumes led to breathless estimates of future growth in telehealth volumes and revenues. In July 2020, McKinsey estimated a total addressable market (TAM) of $250 billion for telehealth services — this from a business with a revenue base McKinsey itself estimated at $3 billion in 2019-2020, and $5.5 billion in 2020-2021. This risible TAM estimate assumed that 24% of all physician and outpatient visits (a 1.8 billion visit “universe”) and 25% of Emergency Department visits would be addressed through telehealth alternatives.

However, more than 90% of telehealth visits during the spring of 2020 were with physicians patients already knew, not random, anonymous physicians signed on to cover telehealth services by vendors. And 47% of those visits were one-time users, according to a recent Trilliant analysis. Visit volume growth was also materially aided by Congressional approval of temporary Medicare coverage for telehealth visits as part of the COVID Public Health Emergency declaration.

Continue reading…

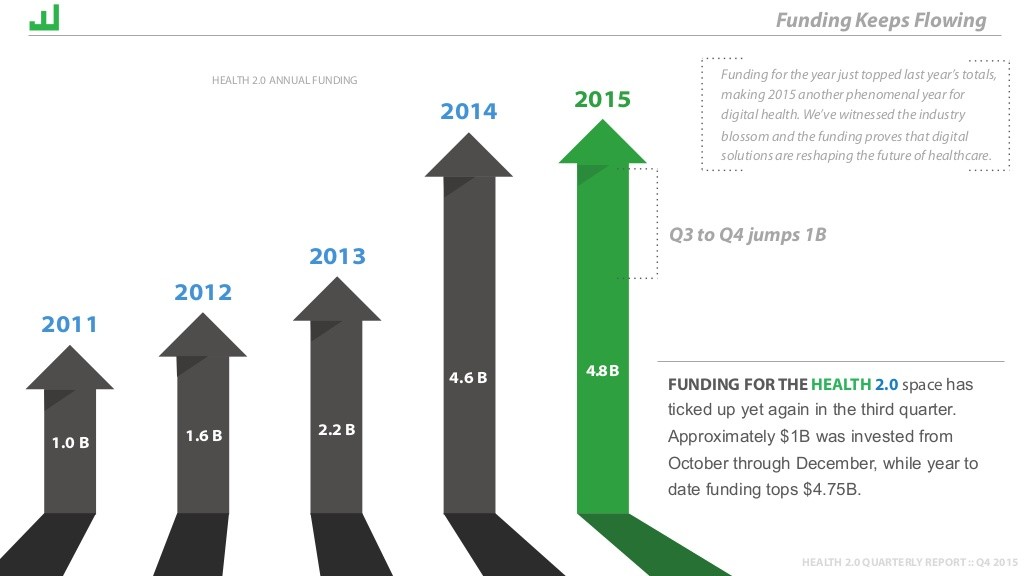

Health 2.0’s numbers in our report were $4.8 billion for the year, as shown on the left. (You can see more on these and some other data in our

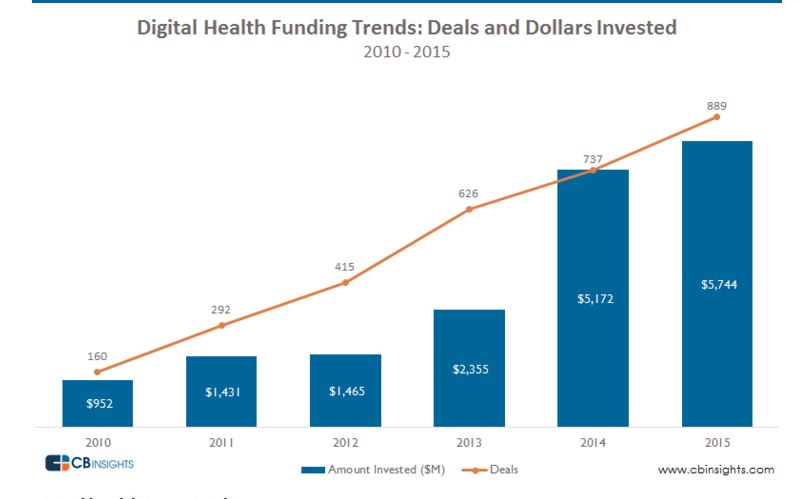

Health 2.0’s numbers in our report were $4.8 billion for the year, as shown on the left. (You can see more on these and some other data in our  And that was the number I’d started the original spat about. But when I looked at the post they released in January 2016, not only was the number for 2015 at $5.7 billion (remember Rock Health, Mercom & Health 2.0 all put it in the mid-high $4s) but the 2014 number had somehow climbed from about $3.5 billion to $5.1 billion.

And that was the number I’d started the original spat about. But when I looked at the post they released in January 2016, not only was the number for 2015 at $5.7 billion (remember Rock Health, Mercom & Health 2.0 all put it in the mid-high $4s) but the 2014 number had somehow climbed from about $3.5 billion to $5.1 billion.  Again

Again