Humana is out with a report saying that its Medicare Advantage members who are covered by value-based care (VBC) arrangements do better and cost less than either their Medicare Advantage members who aren’t or people in regular Medicare FFS. To us wonks this is motherhood, apple pie, etc, particularly as proportionately Humana is the insurer that relies the most on Medicare Advantage for its business and has one of the larger publicity machines behind its innovation group. Not to mention Humana has decent slugs of ownership of at-home doctors group Heal and the now publicly-traded capitated medical group Oak Street Health.

Humana has 4m Medicare advantage members with ~2/3rds of those in value-based care arrangements. The report has lots of data about how Humana makes everything better for those Medicare Advantage members and how VBC shows slightly better outcomes at a lower cost. But that wasn’t really what caught my eye. What did was their chart about how they pay their physicians/medical group

What it says on the surface is that of their Medicare Advantage members, 67% are in VBC arrangements. But that covers a wide range of different payment schemes. The 67% VBC schemes include:

- Global capitation for everything 19%

- Global cap for everything but not drugs 5%

- FFS + care coordination payment + some shared savings 7%

- FFS + some share savings 36%

- FFS + some bonus 19%

- FFS only 14%

What Humana doesn’t say is how much risk the middle group is at. Those are the 7% of PCP groups being paid “FFS + care coordination payment + some shared savings” and the 36% getting “FFS + some share savings.” My guess is not much. So they could have been put in the non-VBC group. But the interesting thing is the results.

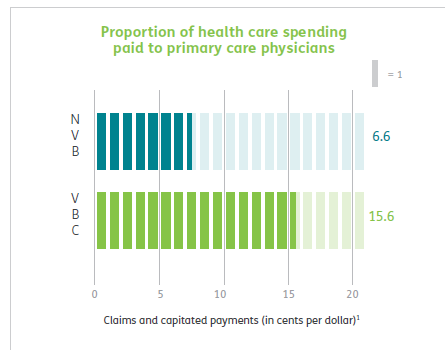

First up Humana is spending a lot more on primary care for all their VBC providers, 15% of all health care spend vs 6.6% for the FFS group, which is more than double. This is more health policy wonkdom motherhood/apple pie, etc and probably represents a lot of those trips by Oak Street Health coaches to seniors houses fixing their sinks and loose carpets. (A story often told by the Friendly Hills folk in 1994 too).

But then you get into some fuzzy math.

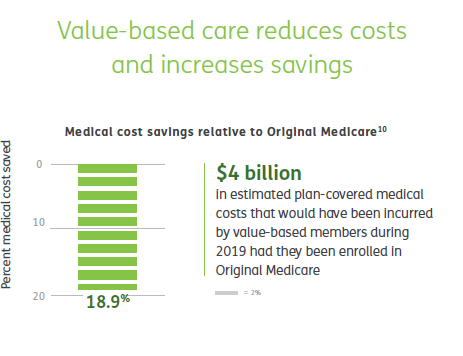

According to Humana their VBC Medicare Advantage members cost 19% less than if they had been in traditional FFS Medicare, and therefore those savings across their 2.4m members in VBC are $4 billion. Well, Brits of a certain age like me are wont to misquote Mandy Rice-Davis — “they would say that wouldn’t they”.

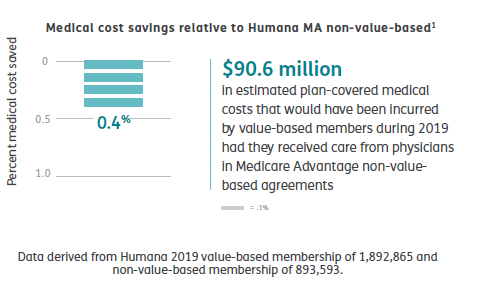

But on the very same page Humana compares the cost of their VBC Medicare Advantage members to those 33% of their Medicare Advantage members in non-VBC arrangements. Ponder this chart a tad.

Yup, that’s right. Despite the strung and dram and excitement about VBC, the cost difference between Humana’s VBC program and its non-VBC program is a rounding error of 0.4%. The $90m saved probably barely covered what they spent on the fancy website & report they wrote about it

Maybe there’s something going on in Humana’s overall approach that means that FFS PCPs in Medicare Advantage practice lower cost medicine that PCPs in regular ol’ Medicare. This might be that some of the prevention, care coordination or utilization review done by the plan has a big impact.

Or it might be that the 19% savings versus regular old Medicare is illusionary.

It’s also a little frustrating that they didn’t break out the difference between the full risk groups and the VBC “lite” who are getting FFS but also some shared savings and/or care coordination payments, but you have to assume there’s a limited difference between them if all VBC is only 0.4% cheaper than non-VBC. Presumably, if the full risk groups were way different they would have broken that data out. Hopefully they may release some of the underlying data, but I’m not holding my breath.

Finally, it’s worth remembering how many people are in these arrangements. In 2019 34% of Medicare recipients were in Medicare Advantage. Humana has been one of the most aggressive in its use of value-based care so it’s fair to assume that my estimates here are probably at the top end of how Medicare Advantage patients get paid for. So we are talking maybe 67% of 34% of all Medicare recipients in VBC, and only 25% of that 34% = 8.5% in what looks like full risk (including those not at risk for the drugs). This doesn’t count ACOs which Dan O’Neill points out are about another 11m people or about 25% of those not in Medicare Advantage. (Although as far as I can tell Medicare ACOs don’t save bupkiss unless they are run by Aledade).

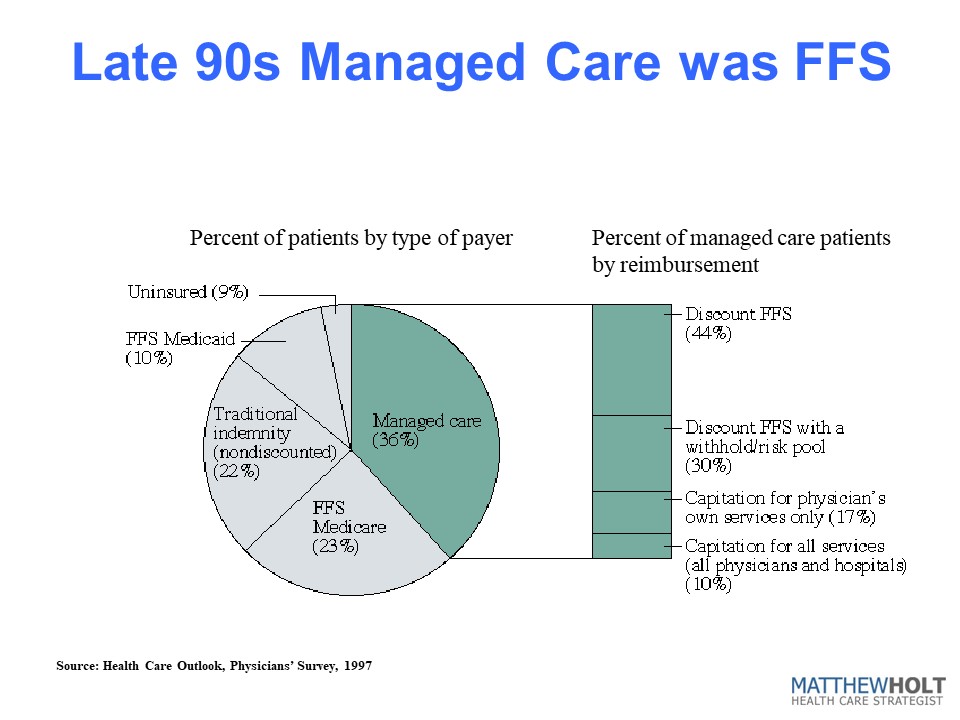

I did a survey in 1997 which some may recall as the height of the (fake) managed care revolution. Those around at the time may recall that managed care was how the health insurance industry was going to save America after they killed the Clinton plan. (Ian Morrison used to call this “The market is working but managed care sucks”). At the time there was still a lot of excitement about medical groups taking full risk capitation from health plans and then like now there was a raft of newly publicly-traded medical groups that were going to accept full risk capitation, put hospitals and over-priced specialists out of business, and do it all for 30% less. The Advisory Board, bless their very expensive hearts, put out a report called The Grand Alliance which said that 95% of America would soon be under capitation. Yeah, right. Every hospital in America bought their reports for $50k a year and made David Bradley a billionaire while they spent millions on medical groups that they then sold off at a massive loss in the early 2000s. (A process they then reversed in the 2010s but with the clear desire not to accept capitation but to lock up referrals, but I digress!).

In the 1997 IFTF/Harris Health Care Outlook survey I asked doctors how they/their organization got paid. And the answer was that they were at full risk/capitation for ~3.6% of their patients. Bear in mind this is everyone, not just Medicare, so it’s not apples to apples with the Humana data. But if you look at the rest of the 36% of their patients that were “managed care” it kind of compares to the VBC break down from Humana. There’s a lot of “withholds” which was 1990s speak for shared savings and discounted fee-for-service. The other 65% of Americans were in some level of PPO-based or straight Medicare fee-for-service. Last year I heard BCBS Arizona CEO Pam Kehaly say that despite all the big talk, the industry was at about 10% VBC and the Humana data suggests this is still about right.

So this policy wonk is a bit depressed, and he’s not alone. There’s a little school of rebels (for example Kip Sullivan on THCB last year) saying that Medicare Advantage, capitated primary care and ACOs don’t really move the needle on cost and anyway no one’s really adopted them. On this evidence they’re right.

Matthew Holt is the Publisher of THCB and is still allowed to write for it occasionally.

Categories: Health Policy, The Business of Health Care

Like Francine, Jeff and Matthew, my memory goes back a long ways. Bravo to Matthew on taking apart the Humana report. MedicareAdvantage does move the needle, of course, but on EPS, not health care costs.

Allow me to disagree slightly with Jeff, however. Yes, “value-based care” has been a religious movement, but saying it doesn’t work is like saying capitation doesn’t work. How much is the capitation amount? What are the rules? When, like Humana and others, you take a bunch of weak-kneed efforts to contain costs and give them the “value” label, you are not doing “Buy Right” — which was the original 1980s idea — but simply renaming a hodgepodge of initiatives. Humana has learned that the way to make lots of money is to take advantage of high government payments for MA, play the games with the quality reports that you can get away with and don’t make doctors too unhappy.

Come to think of it, maybe the “religion” analogy is the right one. Much that goes on in the name of religion has more to do with brandishing the label than it does with doing the right thing.

I’ve been around capitated systems (VBC) since 1983, when Intergroup of Arizona started the first HMO. The great new thing about HMOs was the preventive care, exercise classes, etc. After 7 years, the HMO market collapsed because it didn’t save money, because the patients weren’t any healthier because of all the expensive interventions. The healthy patients who took care of themselves were still healthy, and the others cost a bunch. So in the 90s, we went to PPOs. Now we’re back to capitating the system again, but in Medicare Advantage they reach the patient too late–they’re getting the same folks who refused to take care of themselves in the 80s. I’ve done the math from the patient side and my fancy United Health Supplement is about the same price, coupled with plain vanilla Medicare, as the Medicare Advantage. Of course I don’t take a lot of drugs, and I eat well. I once again re-enrolled in Medicare and paid for my vision with Costco. I’m with Jeff. ‘Far more money has been made by consulting and private equity actors in value based care than in the care system itself.’

Count me with the Rebels. Moody’s Not for Profit Hospital Outlook Report from Sept.2019 showed capitation grew from 1.5% to 1.8% of median hospital revenues from 2014 to 2018 (a 20% increase!) and risk based payment (e.g. two-sided risk short of capitation) from 1.6% to 1.9%! AMGA’s member survey showed capitation was 4% of their members’ revs in 2015 and 7% in 2018, and risk based from 5% to 6% in the same period. AMGA is one of the two professional organizations of risk seeking physician groups (America’s Physician Groups, formerly CAPG, is the other).

There is also no credible evidence of net savings to Medicare from all their activism in this space in the past sad decade, if you count the bonuses paid out to the one in 5 ACOs that beat their targets, the amount by which the remaining ACOs over-ran their targets and the money CMS and care systems spent setting them all up, running them and studying them.

“Value based” payment is a religious movement, not a business trend. And a religious movement fervently supported by my consulting brethren (the fattest goose in the barnyard the past fifteen years) and private equity backed companies like Adelade and Evolent. Far more money has been made by consulting and private equity actors in value based care than in the care system itself.

Count on the Biden administration to stock CMS with true believers and make another run at the line.

As Biden said in the first “debate”, “Inshallah”!